Special Provisions Concerning the Japanese Pension Payments

Page ID:140010060-943-311-592

Last updated date:10 27 2025

Special Provisions Concerning the Pension Payments in Japan

Under the Social Security Agreements, special provisions are provided for the following cases with regard to the Japanese pension payments. According to the special provisions, Japanese benefits will be paid.

Special provisions concerning eligibility requirements for benefits

Special provisions for benefit amount calculation

- Benefit amount calculation based on the length of coverage period (e.g. old-age benefits)

- Benefit amount calculation when the fixed amount is provided irrespective of the length of coverage period (e.g. Disability Basic Pension, Survivors' Basic Pension)

- Benefit amount calculation when the fixed amount is provided with condition of minimum coverage period requirement

Other special provisions

- Special provision for the benefits for persons who were covered by two or more other countries' systems

- Special provision for the suspension of additional benefits (e.g. Additional Pension to Spouses' Old-age Basic Pension)

- When the totalization benefits are payable

- Special provisions regarding the former National Pension Law and the former Employees' Pension Insurance Law

- "Lump-sum Withdrawal Payments for non-Japanese" and "Totalization benefits"

Special provisions concerning eligibility requirements for benefits

1) Totalization both coverage periods under the systems of Japan and the agreement country (old-age benefits)

To be eligible for the Japanese pension benefits such as old-age benefits, you are required a certain coverage period under the Japanese pension systems. If you do not have sufficient coverage period to meet the eligibility requirements for benefits, the totalization enables you to take into account your coverage period under the system of the agreement country which you acquired so that you may qualify for the Japanese benefits.

《Example》 Old-age Basic Pension and Old-age Employees' Pension

Coverage period required for entitlement is 10 years or longer under the Japanese systems

Before the agreements : 3 yrs < 10 yrs → not eligible for the pension benefit

After the agreements : 6 yrs + 3 yrs + 2 yrs = 11 yrs > 10 yrs→ eligible for the pension benefit

《Example》 Additional Pension for Spouses/Children to the Old-age Employees' Pension and Additional Pension to Spouses' Old-age Basic Pension

Coverage period required for entitlement is 20 years or longer under the Japanese system

Before the agreements : 7 yrs < 20 yrs → not eligible for the additional pension benefit

After the agreements : 7 yrs + 8 yrs + 15 yrs = 30yrs > 20 yrs→ eligible for the additional pension benefit

If the contribution was made to the both pension systems between Japan and the other agreement country for the same period, such periods of dual coverage are not counted twice as long.

For example, totalized coverage period in the following chart are not 10 years but 9 years.

《Example》 In case of dual coverage

Also, for any agreement country that has the minimum coverage period requirement for benefits, the Japanese coverage period is taken into account and coverage periods of both countries are totalized.

Please note that it is not that your totalization benefit amounts will be paid from one country. Rather, each country respectively calculates your totalization benefits in proportion to your coverage period under each country's system, and pays the benefits of that country to you separately.

Notes on Individual Rules under each Social Security Agreement

(United States)

Coverage periods totalization for Japanese benefits

(Belgium)

Coverage periods totalization for Japanese benefits

(France)

Coverage periods totalization for Japanese benefits

(Canada)

Coverage periods totalization for Japanese benefits

(Australia)

Coverage periods totalization for Japanese benefits

(Netherlands)

Coverage periods totalization for Japanese benefits

(Ireland)

Coverage periods totalization for Japanese benefits

(India)

Coverage periods totalization for Japanese benefits

(Luxembourg)

Coverage periods totalization for Japanese benefits

(Philippines)

Coverage periods totalization for Japanese benefits

(Slovak Republic)

Method for totalizing Japanese coverage periods into Slovak pension coverage period requirements

(Finland)

Coverage periods totalization for Japanese benefits

(Sweden)

Coverage periods totalization for Japanese benefits

(Austria)

Coverage periods totalization for Japanese benefits

2) Totalization to satisfy "Contribution payment requirement" (disability and survivors' benefits)

As one of the eligibility requirements for disability and survivors' benefits under the Japanese systems, the National Pension Law and the Employees' Pension Insurance Law require that the total period of contribution-paid period and contribution-exempted period need to be more than two-thirds of the entire coverage period (so-called "Contribution payment requirements").

If the total of contribution period to Japanese system is not long enough to satisfy the contribution payment requirement, the coverage period under the agreement country's system can be considered as contribution-paid period under the Japanese National Pension system and periods of both countries are totalized.

Under the Japan-Belgium, the Japan-France, the Japan-Netherlands, the Japan-Czech Republic, the Japan-Spain, the Japan-Ireland, the Japan-Brazil, the Japan-Switzerland, the Japan-India, the Japan-Luxembourg, the Japan-Philippines, the Japan-Slovak Republic, the Japan-Finland, the Japan-Sweden, and the Japan-Austria Agreements, the same rule applies to the eligibility requirements for the Japanese Disability Allowance.

《Example》 Disability Employees' Pension

Before the agreements : 5 yrs/(10 + 5 yrs)= 1/3 < 2/3 → not eligible for the pension benefit

After the agreements : (5 + 15 yrs)/(10 + 5 + 15 yrs)= 2/3 ≧ 2/3 → eligible for the pension benefit

However, the above benefit is not provided if the number of month for the contribution-paid and contribution-exempted periods under the National Pension system and the coverage period under the Employees' Pension Insurance system is zero on date of the first medical examination.

3) Treatment for "Coverage status requirement" (disability and survivors' benefits)

As one of the eligibility requirements for disability and survivors' benefits under the Japanese systems, the systems require that the date of the first medical examination or the date of death lies within specified coverage period. (so called "Coverage status requirements"). Even if the insured or the deceased person is not covered under the Japanese systems on the date of the first medical examination or death, it is considered that this requirement is fulfilled for the purpose of establishing entitlement to the benefit if such date lies within coverage period under the other agreement country's system.

Under the Japan-Belgium, the Japan-France, the Japan-Netherlands, the Japan-Czech Republic, the Japan-Spain, the Japan-Ireland, the Japan-Brazil, the Japan-Switzerland, the Japan-India, the Japan-Luxembourg, the Japan-Philippines, the Japan-Slovak Republic, the Japan-Finland, the Japan-Sweden, and the Japan-Austria Agreements, the same rule applies to the eligibility requirements for the Japanese Disability Allowance.

《Example》 Disability Employees' Pension

Before the agreements : Not insured by the Employees' Pension Insurance system on the date of the first medical examination → not eligible for the benefit

After the agreements : Considered as insured under the Employees' Pension Insurance system on the date of the first medical examination → eligible for the benefit

Notes on Individual Rules under each Social Security Agreement

(United States)

(France)

Special provisions for benefit amount calculation

When you are entitled to the totalized Japanese pension benefits, the benefit amount is calculated on the basis of the coverage period that you paid contributions to the Japanese systems.

Following is one sample of insurance coverage history. Without totalization, this case does not satisfy eligibility requirements for Japanese benefits in being short of enough Japanese period. However if totalized the both countries' periods, the following formulas will be provided for the benefit amounts:

1) Benefit amount calculation based on the length of coverage period (e.g. old-age benefits)

The totalized Japanese benefit amount is calculated based on the proportion of Japanese coverage period according to the Japanese pension laws.

[Type of benefits] Old-age Basic Pension, Old-age Employees' Pension, Survivors' Employees' Pension (for long-term coverage period)

Formula for Old-age Basic Pension

Formula for Old-age Employees' Pension

2) Benefit amount calculation when the fixed amount is provided irrespective of the length of coverage period (e.g. Disability Basic Pension, Survivors' Basic Pension)

The benefits such as the Disability Basic Pension are provided in fixed amount regardless of the length of coverage period. The totalized Japanese benefit amount is calculated in proportion to the coverage period under the Japanese pension system by using specified rate, as long as the eligibility requirements for benefits are satisfied by the Social Security Agreement. The specified rate varies according to each agreement.

[Type of benefits] Additional Pension to Spouses' Old-age Basic Pension (only for benefits for a spouse of a person eligible for the Disability Employees' Pension or the Disability Mutual Aid Pension), Disability Basic Pension, Disability Employees' Pension, Additional Pension for Spouses to the Disability Employees' Pension, Survivors' Basic Pension, Survivors' Employees' Pension, Additional Pension for Middle Age Widows and Transitional measure for Additional Pension for Widows to the Survivors' Employees' Pension (for short-term coverage period), Disability Allowance.

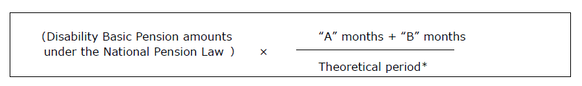

Formula for Disability Basic Pension

(a) Under the Japan-U.S., the Japan-Canada, the Japan-Brazil, the Japan-India and the Japan-Philippine Agreements

*As a general rule, the theoretical period means the period for which a person who is eligible for benefits could be covered by the Japanese systems (from age 20 to 59 after April 1, 1961); contribution-paid period under the Japanese systems or coverage period under U.S. system except for the period between age 20 to 59; and not including the period after the disability recognition or death.

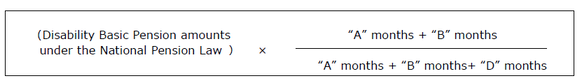

(b) Under the Japan-Germany, the Japan-Belgium, the Japan-France, the Japan-Netherlands, the Japan-Czech Republic, the Japan-Spain, the Japan-Ireland, the Japan-Switzerland, the Japan-Luxembourg, the Japan-Slovak Republic, the Japan-Finland, the Japan-Sweden, and the Japan-Austria Agreements

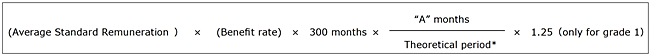

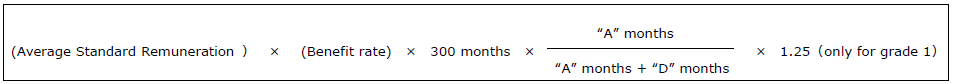

Formula for Disability Employees' Pension (Total coverage period is less than 300 months)

(a) Under the Japan-U.S., the Japan-Canada, the Japan-Brazil, the Japan-India and the Japan-Philippine Agreements

*As a general rule, the theoretical period means the period for which a person who is eligible for benefits could be covered by the Japanese systems (from age 20 to 59 after April 1, 1961); contribution-paid period under the Japanese systems or coverage period under U.S. system except for the period between age 20 to 59; and not including the period after the disability recognition or death.

(b) Under the Japan-Belgium, the Japan-France, the Japan-Netherlands, Japan-Czech Republic, the Japan-Spain, the Japan-Ireland, the Japan-Switzerland, the Japan-Luxembourg, the Japan-Slovak Republic, the Japan-Finland, the Japan-Sweden, and the Japan-Austria Agreements

(C) Under the Japan-Germany Agreement

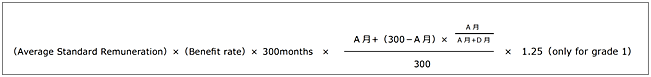

3) Benefit amount calculation when the fixed amount is provided with condition of minimum coverage period requirement

Under the Japanese pension system, following additional benefits are provided in a fixed amount as long as the insured person has a certain coverage period. When the eligibility requirements are satisfied by totalizing both periods of Japan and the agreement country, the benefit amount is calculated according to the proportion of his/her Japanese period against the total coverage period needed for the benefit.

[Type of benefits] Additional Pension to Spouses' Old-age Basic Pension, Additional Pension for Spouses/Children to the Old-age Employees' Pension, Additional Pension for Middle Age Widows and Transitional measure for Additional Pension for Widows to the Survivors' Employees' Pension (for long-term coverage period)

Formula for Additional Pension for Spouses/Children to the Old-age Employees' Pension

*Depending on your date of birth, the number of months can be between 180 and 240 months.

Other special provisions

1) Special provision for the benefits for persons who were covered by two or more other agreement countries' systems

- i.Even if a person, who cannot satisfy the eligibility requirements for benefits under the Japanese public pension laws, was covered under two or more other agreement countries' systems, totalization is possible with one agreement country. (Needless to say, totalization is only available between countries with agreement including totalization arrangement.)

- ii.For such a person mentioned above, who satisfies eligibility requirements for more than one totalization benefits based on his/her coverage period in each country respectively, the highest totalized Japanese benefit amount among them is provided to him/her.

2) Special provision for the suspension of additional benefits (e.g. Additional Pension to Spouses' Old-age Basic Pension)

In principle, additional benefits for (deriving from) dependent spouses provided on top of the old-age or disability benefits are suspended when the spouses become eligible for his/her own old-age or disability benefits. However, under the agreements, these additional benefits are not suspended even when the spouses become eligible for totalization benefits. Please note that when both husband and wife are entitled to these benefits respectively, one additional benefit with higher amount among the two is provided.

For persons who will be entitled to two or more additional benefits to the Old-age Employees' Pension or Retirement Mutual Aid Pension under the Law Concerning Mutual Aid (Association), the highest one will be provided and the other additional benefits are suspended until the said highest benefit is suspended.

3) When the totalization benefits are payable

A person is eligible when he/she satisfies all eligibility requirements including coverage period requirement. Therefore, before the agreement, there were many persons who could not satisfy the coverage period requirement. However, with the implementation of the agreement they may become eligible for benefits (based on totalization provisions). For such persons, benefits are entitled on the effective date of each agreement.

4) Special provisions regarding the former National Pension Law and the former Employees' Pension Insurance Law

- i.Special provisions for eligibility requirements for Coordinated Old-age Pension provided by the former National Pension Law

a) The said special provisions also apply to the eligibility requirements for the Coordinated Old-age Pension

which is specified under the former National Pension Law (before the 1985 amendment).

Practically, with the help of special provisions, persons who did not satisfy coverage period requirement for

the Coordinated Old-age Pension under the former National Pension Law can now totalize their coverage

period of both Japan and other country and may be eligible for the Coordinated Old-age Pension.

b) If persons are eligible for disability benefits specified under the former National Pension Law, and the

date of their first medical examination of another disability was during the coverage period of the other

country, they are considered to be insured under the National Pension system of Japan on the date of their

first medical examination and to be eligible for the Disability Basic Pension with the help of special

provisions. In this case, your disability benefits will be reviewed. Please note that the cases are excluded

when another Disability Basic Pension is provided due to another disability subject to the Disability Basic

Pension.

- ii.Special provisions for eligibility requirements for benefits under the former Employees' Pension Insurance Law

a) The said special provisions also apply to the eligibility requirements for benefits, such as the Old-age

Pension or Coordinated Old-age Pension, which is specified under the former Employees' Insurance Pension

Law (before the 1985 amendment).Practically, with the help of special provisions, persons who did not

satisfy coverage period requirement for the Old-Age Pension or the Coordinated Old-Age Pension under the

former Employees' Pension Insurance Law can now totalize their coverage period of both Japan and other

country and may be eligible for the Old-Age Pension or the Coordinated Old-Age Pension.

b) If persons are eligible for disability pension benefits specified under the former Employees' Pension

Insurance Law, and the date of their first medical examination of another disability was during the coverage

period of the other country, they are considered to be insured on the date of their first medical examination

and to be eligible for the Disability Employees' Pension with the help of special provisions. In this case, your

disability benefits will be reviewed.

5) "Lump-sum Withdrawal Payments for non-Japanese" and "Totalization benefits"

The "totalization of coverage periods" under the Social Security Agreement means the aggregation of the pension insurance periods of Japan and one of the agreement countries, in order to be eligible for pension benefits.

Foreigners must note that there is also "Lump-sum Withdrawal Payments for non-Japanese" which is a one time payment for foreigners who have paid contributions of the National Pension or the Employees' Pension Insurance of Japan for six months or longer. The Payments is provided based on the contribution-paid period and must be claimed within two years after the foreigners leave Japan.

If foreigners receive the Lump-sum Withdrawal Payments, the contribution-paid period which is used to calculate the Payments cannot be used again for totalization under the Social Security Agreements.

Therefore, any foreigners from one of the agreement countries who have future possibility for totalization under the Social Security Agreements must closely compare between future totalization benefits and the Lump-sum Withdrawal Payments.

Notes on Individual Rules under each Social Security Agreement

(Germany)

Totalization for the Lump-sum Withdrawal Payments for non-Japanese