Notes on Individual Rules under the Japan-Czech Social Security Agreement

Page ID:140010060-624-941-772

Last updated date:3 23 2020

1. Crews of ships

In the case that you work as an employee on board a sea-going vessel flying the flag of either Japan or the Czech Republic,you will be subject only to the legislation on compulsory coverage of the agreement country in which your employer is located.

In the case that you work as a self-employed person on board a sea-going vessel flying the flag of either Japan or the Czech Republic, you will be subject only to the social security system on compulsory coverage of the agreement country in which you ordinarily reside.

2. Extension of the period of exemption

If you continue to work as a detached worker in the other country for more than 5 years because of special circumstances including unforeseeable events and serious problems affecting your employer or you, you can continuously be covered only by the social security system of the country from which you have been sent, upon request, if Japan and the Czech Republic agree based on an individual examination. If the extension of exemption is not granted, you will be covered only by the system of the country in which you work during the period exceeding the initial 5 years.

3. Accompanying spouse and children of a person who is covered by the Czech system

When you are temporarily detached from Czech to Japan, thus covered only by the Czech social security system in accordance with the Agreement,your accompanying spouse and child need to be covered by the Japanese health insurance system, while they may voluntarily enroll in the Japanese pension system.

Please note that in principle the Czech health insurance system covers only its nationals or permanent residents.Under the Agreement, however, you will be covered by the Czech health insurance system under the Agreement in the case that you are an accompanying spouse or child of a person who is covered only by the Czech system such as a person who is employed by an employer in Czech and who is detached to Czech by an employer in Japan expectedly beyond 5 years.

4. Coverage periods totalization for Czech benefits

In order to establish your entitlement to benefits under the Czech system, your coverage period under the system of third countries in addition to your coverage period under the Japanese system will be considered if said third countries have concluded a social security agreement with the Czech Republic.

This will not apply if you have a coverage period of less than twelve months under the Czech system.

When you totalize both countries' coverage periods, a coverage period of one month of the Japanese system is deemed to be equal to a coverage period of 30 days under the Czech system since 12 months of the Japanese system is deemed to be equal to 365 days of the Czech system. Nevertheless,the total coverage period in any calendar year cannot exceed 365 days.

5. Czech benefit amount calculation under the Agreement

The following two calculations are used to determine your benefit amount under the Czech system in accordance with the Agreement, and the higher amount will be provided to you.

- The amount calculated only on the basis of a coverage period under the Czech system

- The amount calculated by deeming a coverage period under the Japanese system and coverage periods under the systems of third countries that have concluded social security agreements with the Czech Republic to be a coverage period under the Czech system, which is prorated according to the duration of a coverage period under the Czech system.

6. Retroactive payment of the Czech pension benefits

You can apply for the Czech benefits 4 months before you become eligible for the benefits. Czech pension benefits for each month will be basically retroactively payable for up to 5 years (3 years in principle, in the case you became eligible for the benefits in and before 2008).

7. Payment of Czech benefits

Payments of the Czech benefits are made to beneficiaries in Japan in U.S. dollars; by either of the two following methods:

- Via direct deposit (each time when there is a submission of a life certificate from a beneficiary)

- By check to be sent to your address (every three months, in principle)

* When you file your Czech pension benefits claim, you can opt and designate payment method on the claim form.

Please note that Czech legislation requires Czech pension beneficiaries to submit "Certificate of Living" to receive benefits.

- If you choose payment via direct deposit, you must submit "Certificate of Living" each time you will receive benefits. You can download "Certificate of Living".

- If you choose payment by check, you will receive "Certificate of Living" from Czech Social Security Administration. You must complete the form and submit to the Administration.

If you live in Japan, you need to send completed "Certificate of Living" to the Czech Social Security Administration, either directly or via Branch Office of Japan Pension Service (JPS Branch Office) in Japan. You need either to have signature by Embassy of Czech Republic in Japan on the form, or to attach a certified (extract) copy of your Family Registry, or a certified copy of your Resident Registry.

8. How to apply for Japanese benefits in the Czech Republic

You must visit the local office of Czech Social Security Administration. Accordingly, you must visit the local office of Czech Social Security Administration in order to file your claim for Japanese pension in the Czech Republic. You need to bring necessary documents for the claim. You may send your claim for Japanese pension directly to JPS Branch Office in Japan by mail.

9. Income tax on Japanese pension benefits in the Czech Republic

If you receive Japanese pension benefits in the Czech Republic, your Japanese benefits are subject to income tax in the Czech Republic and exempt from Japanese income tax.

To be exempt from Japanese income tax under this rule, you must submit two completed "Claim Form for Income Tax Convention (Form 9)" to the Headquarters of Japan Pension Service.You can download the form from![]() "the Japanese National Tax Agency website".(外部リンク)

"the Japanese National Tax Agency website".(外部リンク)

10. Procedures for exemption for the persons who have concluded employment contracts with local subsidiaries in the Czech Republic

Regarding procedures for exemption from the Czech social security systems for employees temporarily detached from Japan to the Czech Republic who conclude employment contracts with a place of business in the Czech Republic, the following changes shall occur in accordance with the Protocol Amending the Agreement Between Japan and the Czech Republic (hereinafter referred to as the “Amended Agreement”) coming into effect from August 1, 2018.

Prior to the Amended Agreement coming into effect, procedures for issuing certificates of coverage differed according to whether or not there was an employment contract with a place of business within the Czech Republic. However, as from August 1, 2018, the procedures will be as follows.

Regarding procedures for employees sent to the Czech Republic on or after August 1, 2018

1. In cases where an employee does not conclude an employment contract in the territory of that other Contracting state (Czech Republic) (Article 7, paragraph 1, subparagraph (a))

→As has been the case to date; a certificate of coverage will be issued by the Japan Pension Service without consulting with the liaison agency of the Czech Republic

2. In cases where an employee concludes an employment contract with an employer with a place of business in the territory of that other Contracting State (Czech Republic), but is under the direction of the employer with a place of business in the territory of the first Contracting State (Japan) (Article 7, paragraph 1, subparagraph (b))

→To date, certificates of coverage were issued after consulting with the Czech Republic. However, as from August 1, 2018, certificates of coverage will be issued by the Japan Pension Service without consulting with the liaison agency of the Czech Republic.

In cases where an employee is to be sent to the Czech Republic on or after the date of entry into force of the Amended Agreement, please apply to the Japan Pension Service for a certificate of coverage based on Article 7, paragraph 1, subparagraph (a) or (b) before dispatching the employee.

Note 1) In applying for the issuance of a certificate of coverage, requirements other than those stated above must also be satisfied. (E.g., the period of such detachment is not expected to exceed five years, etc.)

Note 2) For (2) above, “under the direction of the employer with a place of business in the territory of the first Contracting State (Japan),” indicates that the employer in Japan has the authority to take actions, such as conducting personnel management activities for temporarily detached employees.

Note 3) In either of the cases above (1) or (2), on the certificate of coverage it shall be noted as corresponding to “Article 7, paragraph 1” as has been the case to date. Additionally, for the temporarily detached period noted on the certificate of coverage, even if there is a change from (1) to (2) (or vice versa), there is no need to apply for a new certificate of coverage.

Regarding procedures for employees sent to the Czech Republic on or before July 31, 2018

1. For persons that have been sent to the Czech Republic before the Amended Agreement comes into effect and have already received a certificate of coverage that has been issued, the certificate remains valid even after the Amended Agreement comes into effect.

2. For persons that have been sent to the Czech Republic before the Amended Agreement comes into effect, but have not received a certificate of coverage or are in the process of applying for such:

If such persons have not concluded an employment contract in the territory of that other Contracting State (Czech Republic), please promptly apply to the Japan Pension Service for the issuance of a certificate of coverage (based on Article 7, paragraph 1, subparagraph (a)).

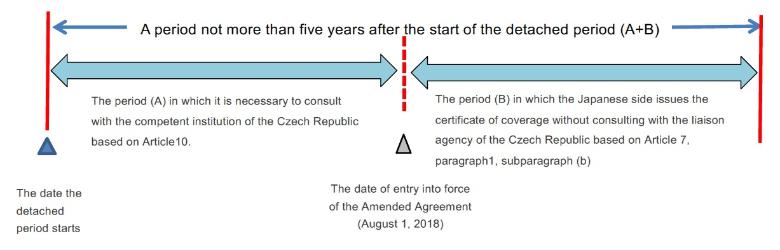

If such persons have concluded an employment contract with an employer with a place of business in the territory of that other Contracting State (Czech Republic), regarding the dispatch period after the Amended Agreement comes into effect, please apply to the Japan Pension Service for the issuance of a certificate of coverage for both (A) the period on or before July 31, 2018 and (B) the period on or after August 1, 2018.

Regarding period (A), based on Article 10 of the Agreement, a certificate of coverage will be issued after consulting with the liaison agency of the Czech Republic (If consultation pertaining to the same Article is already underway, then a certificate of coverage will be issued based on the result of the consultation).

Regarding period (B), regardless of the consultation pertaining to period (A), based on Article 7, paragraph 1, subparagraph (b), the person shall be exempt from the Czech social security system, as such, please apply to the Japan Pension Service for the issuance of a certificate of coverage for period (B) after the date the Amended Agreement comes into effect.

However, regarding period (B), for the starting date of the maximum length of the temporarily detached period, which is five years, it will not be from the effective date of the Amended Agreement, but rather from the start of the detached period which began before the date the Amended Agreement comes into effect.

Reference 1: Application for extension

When extending the detached period beyond five years, there is no change in the need to comply with rule 2 above. However, for employees who have a certificate of coverage under Article 7, paragraph 1, applications for extension will be carried out based on Article 7, paragraph 2. For employees who have a certificate of coverage under Article 10, applications for extensions will be carried out based on Article10.

Reference 2: In cases where an employee concludes an employment contract with an employer with a place of business in the territory of that other Contracting State (Czech Republic) before the date of entry into force of the Amended Agreement (August 1, 2018), please refer to the following.

![]() Notes to employers sending workers from Japan to Czech Republic (Japanese) (PDF 110KB)

Notes to employers sending workers from Japan to Czech Republic (Japanese) (PDF 110KB)

![]() Follow – up notes to employers sending workers from Japan to Czech Republic (Japanese)(PDF 124KB)

Follow – up notes to employers sending workers from Japan to Czech Republic (Japanese)(PDF 124KB)