Notes on Individual Rules under the Japan-Spain Social Security Agreement

Page ID:140010060-407-803-203

Last updated date:3 9 2022

1. Crews of ships

In case that you work as an officer or member of a crew on board a sea-going vessel flying the flag of the country, if you would otherwise be compulsorily covered by the social security systems of both countries, you will be subject only to the social security systems of the country of the flag. If you are employed in the other country, you will be subject to the system of the country in which your employer is located. A self-employed person on board a sea-going vessel is not subject to the Spanish social security system. The procedure to apply for your Certificate of Coverage under this rule is the same as that for general employees.

2. Crews of aircrafts

If you work as an employee on an aircraft in international traffic, you will be subject only to the social security systems of the country in which your employer is located.

3. Workers' Accident Compensation Insurance (la protección de los accidents de trabajo)

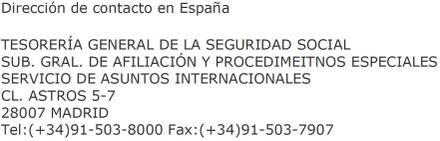

If you are sent to Spain, you will be exempt from coverage of the Spanish pension system by submitting your Japanese Certificate of Coverage and photocopy of your passport to your Spanish employer. In addition to be exempt from the Spanish pension system, you will also be exempt from other Spanish social security systems (health insurance and employment insurance). However, you must be covered by Spanish workers’ accident compensation insurance system. The Spanish employer or self-employed person himself/herself need to join the Spanish workers’ accident compensation Insurance system in accordance with the Spanish law. Please contact TGSS below for further information:

4. Extension of the period of exemption

If you need to continue to work as a detached worker (or a self-employed person) in the other country for more than 5 years because of unforeseen circumstances, you may be granted extension of the period of exemption for up to 3 years, upon request, if Japan and Spain agree based on an individual examination. In this case, you continue to remain subject only to the system in your original country where you are detached from. Related to the extension, you need to report why you need the extension. You have to provide more specific reasons, especially for extension for more than 2 years. If the extension is not granted, you will be covered only by the system of the country in which you work during the period exceeding the initial 5 years.

5. Coverage periods totalization for Spanish benefits

If you do not have enough Spanish coverage periods alone to qualify for benefits, your coverage period under the Japanese pension systems will be considered for Spanish benefits. For this purpose, however, your Spanish coverage periods need to be more than one year. As for Spanish disability and survivors benefits, you will qualify for these benefits in case you become disabled or die while you are covered by the Japanese pension system.

6. Spanish benefit amount calculation under the Agreement

The following two calculations are used to determine your benefit amount under the Spanish system in accordance with the Agreement, and the higher amount will be provided to you.

- The amount calculated only on the basis of a coverage period under the Spanish system.

- The amount calculated by deeming a coverage period under the Japanese system to be a coverage period under the Spanish system, which is prorated according to the duration of a coverage period under the Spanish system.

7. Retroactive payment of the Spanish pension benefits

You can claim for the Spanish pension benefits 3 months before you satisfy eligibility requirements for the benefits.

The Spanish pension benefits will be provided from the month that you satisfy all eligibility requirements for the benefits. If there are more than 3 months between the date you reach the pensionable age and the date you file your claim, you will be paid retroactively up to 3 months.

8. Payment of Spanish benefits

The Spanish pension benefits are paid to you 14 times a year (half-yearly or quarterly payment is possible upon your request) by check or bank transfer. The benefits are made in Euros, but converted into yen when deposited in bank account in Japan.

9. Income tax on Japanese pension benefits in Spain

If you receive Japanese pension benefits in Spain, your Japanese benefits are subject to income tax in Spain and exempt from Japanese income tax.

To be exempt from Japanese income tax under this rule, you must submit two completed "Application form for Income Tax Convention (Form 9)" to the Headquarters of Japan Pension Service. You can download the form from ![]() the Japanese National Tax Agency website.(外部リンク)

the Japanese National Tax Agency website.(外部リンク)