National Pension System

Page ID:100-517-268-995

Last updated date:11 28 2025

The National Pension is a public pension system participated by all persons aged 20 to 59 years who have an address in Japan, which provides benefits called the “Basic Pension” due to old age, disability, or death.

Coverage

Compulsory Coverage

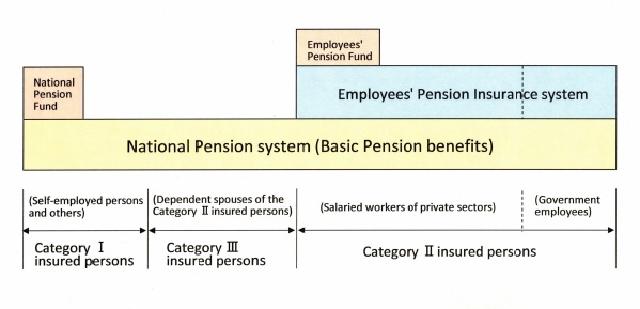

All registered residents of Japan aged 20 to 59 years must be covered by the National Pension system. The insured persons under the National Pension system are categorized to three types according to their status as follows:

[Note] Persons moving into Japan must be covered by the National Pension as the Category Ⅰ insured person for the period from their entry to Japan until they become subject to the Category Ⅱ or Ⅲ insured persons.

[Note] Foreign nationals with specific visa (medical stay or long stay for sightseeing) are excluded from coverage: they cannot enroll in the National Pension as the Category Ⅰ or Ⅲ insured persons.

[Note] Self-employed workers who temporarily work in Japan, from a country which has Social Security Agreement with Japan, may be exempted from NP coverage: See for details.

Category Ⅰ insured persons:

All registered residents of Japan aged 20 to 59 years who are not the Category Ⅱ or Ⅲ insured persons (including agriculture, forestry, or fishery business operators, self-employed persons, students.)

Category Ⅱ insured persons:

Persons enrolled in the Employees’ Pension Insurance system or Mutual Aid Associations. (except for persons aged 70 years or older who are eligible to receive a pension due to old age or retirement)

Category Ⅲ insured persons:

Category Ⅱ insured persons’ dependent spouses aged 20 to 59 years, who reside in Japan. (excluding spouse of Category Ⅱ insured person who reached 65 years and eligible to receive the Old-age Basic Pension)

[Note] Effective April 1st, 2020 you need to reside in Japan in order to be a Category Ⅲ insured person. However, even without an address in Japan you can enroll in the National Pension as the Category Ⅲ insured person if you are, for example, a student studying abroad or a family member accompanying a worker detached to work in a foreign country, who is described by one of the following categories of exceptional coverage:

(1) a student studying in a foreign country

(2) an accompanying person of a Category Ⅱ insured person who is sent to work in a foreign country

(3) a person who temporarily stays in a foreign country, for non-work-related purposes, such as sightseeing, leisure, and volunteerism

(4) a person recognized as equivalent to (2), who has become an accompanying person of a detached Category Ⅱ insured worker working in a foreign country

(5) a person who has justifiable reasons, taking into account various conditions such as purpose of travel, to be recognized that their livelihood is Japan-related

How to Enroll in the System and Register yourself under each Category

When you become subject to the Category Ⅰ insured person, you need to register yourself at the municipal office of your place of residence within 14 days, by submitting the “Application to Enroll in National Pension as Category Ⅰ Insured Person” (KOKUMIN NENKIN HIHOKENSHA KANKEI TODOKESHO (MOSHIDESHO.)

When you become subject to the Category Ⅱ insured person, your employer needs to enroll you in the Employees’ Pension Insurance or the Mutual Aid Associations. Within the procedure you are automatically enrolled in the National Pension, so you do not need to take extra procedure.

When you become subject to the Category Ⅲ insured person, you may have your spouse’s employer register you at the Japan Pension Service branch office (JPS branch office) that covers your spouse's workplace, within 14 days, by submitting the "National Pension: Application to enroll in as Category Ⅲ Insured Person" (KOKUMIN NENKIN: SANGO HIHOKENSHA KANKEI TODOKE.)

Voluntary Coverage

The following persons can enroll in the National Pension system on a voluntary basis;

(1) Registered residents* of Japan aged 60 to 64 years

(2) Japanese citizens aged 20 to 64 years who reside in a foreign country

(3) Persons* born on or before April 1, 1965, aged 65 to 69 years who have not satisfied the minimum qualification period

* Excluding foreign nationals staying in Japan with specific visa (medical stay or long stay for sightseeing.) Such foreign nationals cannot apply for voluntary coverage.

How to Enroll for Voluntary Coverage

If you are subject to (1), (3) above, and wish to enroll voluntarily, you need to apply for enrollment at the municipal office of your place of residence. If you are subject to (2) above, you need to apply for enrollment at the JPS branch office in charge of your latest residence in Japan. If you have never resided in Japan, you need to apply at the JPS Chiyoda Branch Office, Tokyo.

Contributions

The contribution amount for the National Pension is \17,510/month (for the fiscal year 2025)

Payment of the Contributions

You can pay the contributions at banks, post offices, or convenience stores using the payment invoices sent to you by the JPS. You may take advantage of a discount by various payment options including advance payment, automatic bank account transfer, or credit card payment.

Exemption of the Contributions

You can apply for the exemption from contribution payments if you satisfy certain conditions specified by law, specifically, if you are receiving the Disability Basic Pension or the Public Assistance under the Livelihood Protection Act. You may also be exempt from contribution payments if the previous year's income of you/your spouse/head of household is limited, and if your application for exemption is granted.

The type of exemption and monthly contribution amount for the fiscal year 2025 are as follows;

- full-amount-exemption

- 3/4-amount-exemption (\4,380)

- half-amount-exemption (\8,760)

- 1/4-amount-exemption (\13,130)

For the purpose of calculation of your pension benefits, your periods of full-amount-exemption for March 2009 and earlier will count as one-third of full-contribution-paid periods (the 3/4-amount-exemption periods will count as half, the half-amount-exemption periods as two-thirds and the 1/4-amount-exemption periods as five-sixths.) Your periods of full-amount-exemption for April 2009 and later will count as half of full-contribution-paid periods (the 3/4-amount-exemption periods will count as five-eighths, the half-amount exemption periods as three-fourths and the 1/4-amount-exemption periods as seven-eighths.)

If you fail to pay the due remaining contribution amount during the granted period, however, it will be considered to be non-payment rather than partial exemption.

How to Apply for Exemption

To take advantage of the exemption, you need to apply for it at the municipal office of your place of residence. You need to apply for it every year.

Recovery of the Past Exempted-Contribution

You may retroactively make payments for past contribution-exempted periods for up to the past 10 years. Please note that a specific index will be imposed on your past contribution amount when you recover the payments. That is, if you were granted the contribution exemption in a certain fiscal year (April to March) and if you wish to recover the contribution three or more fiscal years later, your old contribution amount is indexed by certain rate according to the age of the due contribution.

[Note] Please make sure to apply for the retroactive payments well in advance. If applied just before the deadline, your payments may not be technically accepted in time.

How to Recover the Exempted Contribution

For retroactive payments, please contact your nearest JPS branch office.

Special Payment System for Students

If you are a student and your income is less than a certain amount, you may be allowed to postpone contribution payment if your application is approved.

This granted period protects you just as the contribution-paid periods do. So, if you become disabled or die during this granted period, the Disability Basic Pension or the Survivors' Basic Pension will be provided if you satisfy the following conditions;

(1) By the second month preceding the month of incident causing disability or death, you have filled at least two-thirds of your insured periods (months) with contribution paid periods and contribution-exempted periods.

(2) You have paid your contributions or you were exempted from the contributions payments for the last 12 months up to the second month preceding the month of incident causing disability or death.

The granted periods count as qualifying periods for the Old-age Basic Pension, however, unless you recover contribution payments afterwards, the periods will not be reflected to the old-age benefit amount.

You can retroactively pay the postponed contribution in the same way as the "Recovery of the Past Exempted-Contribution" above.

How to Apply for Special Payment System for Students

To take advantage of the special payment system for students, you need to apply for it at the municipal office of your place of residence. You need to apply for the system for students every year.

Contribution Postponement System for Limited Income Persons

If you are aged under 50 and your/your spouse's income is lower than a certain level, this system allows you to postpone your contribution payments. It aims to protect persons who are not granted contribution exemption, from failing to qualify for benefits in later life. To take advantage of your postponement, your application needs to be granted.

If you become disabled or die during the granted periods, the Disability Basic Pension or the Survivors' Basic Pension will be provided if you satisfy the same conditions mentioned in "Special Payment System for Students" above.

The granted periods count as qualifying periods for the Old-age Basic Pension, however, unless you recover contribution payment afterwards, the periods will not be reflected to the old-age benefit amount.

You can apply for postponement system or retroactively pay the postponed contribution in the same way mentioned in "Exemption of the Contributions" and "Recovery of the Past Exempted-Contribution" above.

Benefits

Old-age Basic Pension

You can receive the Old-age Basic Pension at the age of 65 if you have been covered under the National Pension and Employees' Pension Insurance systems for 10 years or more*.

* Your total coverage periods include your contribution-paid periods as well as your contribution-exempted periods as a Category Ⅰ, Category Ⅱ or Category Ⅲ insured person.

Benefit Amount (Fiscal year 2025)

\831,700* (annual benefit amount; if you have paid contributions for 40 years)

If you have periods for which you failed to pay or your contribution was exempted, the amount is;

\831,700* x ( (1) + (2) + (3) + (4) + (5) ) / 40 years ** × 12 months

(1) Number of contribution-paid months (no exemption)

(2) Number of full contribution-exempted months*** × 1/2

(3) Number of three-quarter contribution-exempted months*** × 5/8

(4) Number of half contribution-exempted months*** × 3/4

(5) Number of one-quarter contribution-exempted months*** × 7/8

* \829,300 for a beneficiary born on or before April 1,1956

** Shorter for some people, depending on date of birth

*** Depending on your income or according to the National Pension Act, you may be granted an exemption of full- or partial- amount of contribution payment.

For items (2) to (5) above, apply the formula below if your contribution is exempted for March 2009 and earlier:

(2) Number of full contribution-exempted months × 1/3

(3) Number of three-quarter contribution-exempted months × 1/2

(4) Number of half contribution-exempted months × 2/3

(5) Number of one-quarter contribution-exempted months × 5/6

How to Claim Your Old-age Basic Pension

You need to file the “Application for Pension: Old-age Benefits under National Pension / Employees’ Pension Insurance” (NENKIN SEIKYUSHO: KOKUMIN NENKIN / KOSEI NENKIN HOKEN ROREI KYUFU) to your nearest JPS branch office or pension consultation center (PCC.)

You need to provide following documents:

(1) an official document which shows your Basic Pension Number, including your Basic Pension Number Notice and Pension Handbook

(2) a certified extract copy of your Family Registry (KOSEKI SHOHON)

However, you do not need to provide the above-mentioned documents in principle if you are single and already registered your My Number to the JPS.

Please contact the JPS branch office to find about other specific documents.

Option of “Early Payment” or “Delayed Payment”

The pensionable age for the Old-age Basic Pension is 65 in principle. However, you may opt to receive pension at any age after 60. The pension amount is adjusted depending on the age you start to receive your pension. You may opt to start benefits before 65 with lower benefits amount, or you may opt to start benefits at 66 or later with higher benefits amount. Specifically, your early pension amount receivable at the age of 60 is 76 % of that for age 65 and your delayed pension amount receivable from the age of 75 or older is 184 %.

Please note that once you start receiving your payment, the receivable rate will not change for the rest of your life. Also note that you cannot apply for the Disability Basic Pension if you have onset of disability after the entitlement date of the early payment of Old-age Basic Pension. (Date of "onset of disability" is the date of your first medical examination of sickness or injury causing the disability.)

How to Apply for the "Early Payment" or "Delayed Payment"

Early Payment

If you opt for the early payment of your Old-age Basic Pension, you need to file appropriate application forms as below, to your nearest JPS branch office or PCC:

If you apply for Old-age Basic Pension for the first time, please file "Application for Pension: Old-age Benefits under National Pension / Employees' Pension Insurance" (NENKIN SEIKYUSHO: KOKUMIN NENKIN / KOSEI NENKIN HOKEN ROREI KYUFU) and "Application for Early Payment of Old-age Employees' Pension / Old-age Basic Pension" (ROREI KOSEI NENKIN / ROREI KISO NENKIN: SHIKYU KURIAGE SEIKYUSHO.)

If you are currently receiving specially-provided Old-age Employees' Pension, please file "Application for Early Payment of Old-Age Basic Pension for Beneficiary of Specially-provided Old-age Employees' Pension" (TOKUBETSU SHIKYUNO ROREI KOSEI NENKIN JUKYUKENSHA ROREI KISO NENKIN SHIKYU KURIAGE SEIKYUSHO.)

Delayed Payment

If you opt for the delayed payment of your Old-age Basic Pension, you need to file appropriate forms as below, to your nearest JPS branch office or PCC:

If you apply for old-age pension for the first time, please file "Application for Pension: Old-age Benefits under National Pension / Employees’ Pension Insurance” (NENKIN SEIKYUSHO: KOKUMIN NENKIN / KOSEI NENKIN HOKEN ROREI KYUFU) and "Application for Delayed Payment of Old-age Employees' Pension / Old-age Basic Pension" (ROREI KOSEI NENKIN / ROREI KISO NENKIN: SHIKYU KURISAGE MOSHIDESHO.)

If you had received specially-provided Old-age Employees’ Pension in the past, please file "Application for Delayed Payment of Old-age Basic Pension / Old-age Employees’ Pension" (ROREI KISO NENKIN / ROREI KOSEI NENKIN - SHIKYU KURISAGE SEIKYUSHO.)

Additional Pension Plan

There is an extra voluntary plan for Category Ⅰ insured person to pay a small additional benefit to your Old-age Basic Pension. If you opt for this plan and pay the contribution of \400 / month, you can receive additional benefit, to which the same receivable rates as early / delayed payment apply. However, this contribution is not subject to the Lump-sum Withdrawal Payments.

Benefit Amount

Annual amount = \200 × Number of months to which you paid the Additional Contribution

Disability Basic Pension

You can receive the Disability Basic Pension when you have a certain level of disability (Grade 1 or Grade 2) which are specified by law. To qualify, the date of first medical or dental examination* must be during the periods as follow:

- you were covered by the National Pension.

- you were younger than age 20 (not covered by public pension system.)

- you were aged between 60 and 64 (not covered by public pension system) and resided in Japan.

* Date of first medical or dental examination means the date when you received first medical examination by a doctor or dentist for your sickness or injury which caused a disability

In addition, you must satisfy either one of the two following contribution payment requirements as of the previous day of the date of your first medical examination.

(1) At least two-thirds of the period of your past coverage is filled with your contribution-paid periods and contribution-exempted periods (paid or exempted up to 2 months prior to your first medical examination month.)

(2) You are aged under 65 on the date of your first medical examination, and you have paid contributions or you were exempted from the contribution payments for 12 consecutive months up to 2 months prior to your first medical examination month.

Benefit Amount (Fiscal year 2025)

Grade 1 Disability Basic Pension: \1,039,625* / year

Grade 2 Disability Basic Pension: \831,700** / year

- \239,300 each for your first and second child***

- \79,800 each for your third and subsequent child***

* \1,036,625 for a beneficiary born on or before April 1, 1956

** \829,300 for a beneficiary born on or before April 1, 1956

*** Additional annual benefits are paid when you have eligible dependent child(ren). Eligible dependent children must be under age 18 (until first March 31 after his/her 18th birthday) or age 20 if he/she has a certain grade of disability specified by pension law.

How to Claim Your Disability Basic Pension

You need to file the "Application for Pension: Disability Basic Pension under National Pension" (NENKIN SEIKYUSHO: KOKUMIN NENKIN - SHOGAI KISO NENKIN) at the municipal office of your place of residence. If your first date of medical examination belongs to the period when you were a Category Ⅲ insured person, you need to file the application to your nearest JPS branch office or PCC.

You need to provide following documents:

(1) an official document which shows your Basic Pension Number, including your Basic Pension Number Notice and Pension Handbook

(2) a certified extract copy of your Family Registry (KOSEKI SHOHON)

(3) the certificate of diagnoses issued by your medical doctor

(4) your report on your medical history and on how your disability affect your work / everyday life

(5) other documents if needed for individual cases

Please contact the municipal office or the JPS branch office to find about specific documents, which may vary depending on your conditions.

Survivors' Basic Pension

If an insured person dies while contributing to the National Pension, the Survivors' Basic Pension is payable to the deceased person's spouse who takes care of the deceased person's dependent child(ren), or the deceased person's dependent child(ren). An eligible child must be aged 18 or under (until first March 31 after his/her 18th birthday) or aged 20 if he/she has a certain grade of disability specified by pension law. To satisfy the contribution requirement, as of the previous day of the death, at least two-thirds of the deceased person's total coverage periods must be filled with contribution paid periods or contribution exempted periods (paid or exempted up to 2 months prior to the month of his/her death.) or if he/she dies in March 2026 or earlier, his/her contribution must have been paid or exempted for 12 consecutive months up to 2 months prior to the month of his/her death.

Benefit Amount (Fiscal year 2025)

<Survivors’ Basic Pension for the spouse of the deceased who takes care of one child>

\1,071,000 /year (\831,700* + \239,300 (additional annual benefits for first child**))

* \829,300 for a survivor of the deceased person born on or before April 1, 1956

** Additional annual benefits for the second and subsequent child are as follows;

- \239,300 for the second child

- \79,800 each for the third and subsequent child

<Survivors' Basic Pension for one child>

\831,700 /year (basic amount)

If there are two eligible children, \239,300 is added to this basic amount and the total amount is divided evenly between the two. For the third or subsequent child, further \79,800 is added for each subsequent child and the grand benefit total is equally shared among all children.

How to Claim Your Survivors' Basic Pension

You, as eligible survivor, need to file the “Application for Pension: Survivors’ Basic Pension under National Pension” (NENKIN SEIKYUSHO: KOKUMIN NENKIN – IZOKU KISO NENKIN) to your nearest JPS branch office or PCC.

You need to provide following documents:

(1) an official document which shows the deceased person’s Basic Pension Number, including his/her Basic Pension Number Notice and Pension Handbook

(2) a certified copy of his/her Family Registry (KOSEKI TOHON) or an official copy of the list of legal heir (HOTEI SOZOKU JOHO ICHIRANZU) which can be issued by Legal Affairs Bureau.

(3) a medical certificate on his/her death issued by a medical doctor

Please contact the JPS branch office to find about specific documents you need to submit.

If the deceased person has the coverage period exclusively as a Category Ⅰ insured person, the application needs to be filed to the municipal office of your place of residence, instead of a JPS branch office.

Widow's Pension

If your husband dies after contributing for at least 10 years* as the Category Ⅰ insured person and if he has received neither Old-age Basic Pension nor Disability Basic Pension as of the previous day of his death, you can receive the Widow’s Pension while you are aged 60 to 64. To qualify, you need to have been married to him for at least 10 years and have been financially supported by him at the time of his death.

* Contribution-exempted periods are proportionally calculated: we count 1/4 of his coverage periods (months) exempt from 3/4 contribution payment, half of his coverage periods (months) exempt from half contribution payment, and 3/4 of his coverage periods (months) exempt from 1/4 contribution payment.

Benefit Amount

Equivalent to your late husband's unpaid Old-age Basic Pension (based only on the Category Ⅰ insured periods as of the previous day of his death) x 3/4

How to Claim Your Widow's Pension

You need to file the "Application for Pension: Widow's Pension under National Pension" (NENKIN SEIKYUSHO: KOKUMIN NENKIN - KAFU NENKIN) at the municipal office of your place of residence.

You need to provide following documents:

(1) an official document which shows deceased husband’s Basic Pension Number, including Basic Pension Number Notice and Pension Handbook

(2) a certified copy of your Family Registry (KOSEKI TOHON,) or a certified copy of your (and your deceased husband's) Resident Registry (JUMINHYO)

Please contact any JPS branch office to find about other specific documents you need to submit.

Revision of the Pension Amount

The pension amount is revised each fiscal year according to changes in wages and prices, as stipulated by law. When your pension amount is revised, you will receive "Notice of Pension Amount Change" (shown below.)

Following information are indicated in each block on the Notice you receive:

(1) Annual amount of your National Pension (Basic Pension); basic benefits, suspended amount, and total benefits to be paid

(2) Annual amount of your Employees' Pension Insurance; basic benefits, suspended amount and total benefits to be paid

(3) Annual total pension amount; sum of your National Pension benefits and your Employees' Pension Insurance benefits to be paid

Note: Pension benefits are, in principle, paid in even-numbered months (February, April, June, August, October, and December,) in amount of two months’ benefits.

Lump-sum Death Benefit

When an insured person dies without receiving any pension benefits his/her family member who shared the livelihood with him/her can receive the Lump-sum Death Benefit.

The deceased insured person needs to have at least 36 contribution-paid months* as a Category Ⅰ insured person in total as of the previous day of his/her death.

* Contribution-exempted periods are proportionally calculated: We count 1/4 of his/her coverage periods (months) exempt from 3/4 contribution payment, half of his/her coverage periods (months) exempt from half contribution payment, and 3/4 of his/her coverage periods (months) exempt from 1/4 contribution payment.

Benefit Amount

Between \120,000 and \320,000 depending on the contribution-paid periods of the deceased person

How to Claim Lump-sum Death Benefit

You need to file the “Application for Lump-sum Death Benefit” (KOKUMIN NENKIN SHIBO ICHIJIKIN SEIKYUSHO) at the municipal office of your place of residence.

You need to provide following documents:

(1) the deceased person’s Basic Pension Number Notice, Pension Handbook, or any official document which shows the Basic Pension Number

(2) a certified copy of your Family Registry (KOSEKI TOHON) or an official copy of the list of legal heir (HOTEI SOZOKU JOHO ICHIRANZU) which can be issued by Legal Affairs Bureau.

(3) a certified copy of your (and deceased person's) Resident Registry (JUMINHYO)

Please contact any JPS branch office for details of documents you need to submit.

Lump-sum Withdrawal Payments (Exclusively for Non-Japanese Citizens)

If you are not a Japanese citizen and you had resided in Japan and had been covered by the Japanese pension system for a short time, you can claim the Lump-sum Withdrawal Payments within two years after your departure from Japan. You can claim the Payments if you have at least 6 months of coverage periods* as a Category Ⅰ insured person under the National Pension system and you have not been eligible for pension benefits.

* Contribution-exempted periods are proportionally calculated: We count 1/4 of your coverage periods (months) exempt from 3/4 contribution payment, half of your coverage periods (months) exempt from half contribution payment, and 3/4 of your coverage periods (months) exempt from 1/4 contribution payment.

Please refer to the "Lump-sum Withdrawal Payments" details / application form in English, Chinese, Korean, Portuguese, Spanish, Indonesian, Tagalog, Thai, Vietnamese, Myanmar, Khmer, Russian, Nepali and Mongolian.

Direct Deposit to Foreign Countries

If you reside outside Japan and want your Japanese pension benefits or lump-sum benefits deposited to your account of a bank located outside Japan, you need to submit the form to report your bank details for direct deposit (PDF) to the JPS branch office which is in charge of your final address in Japan, or any JPS branch office if you don’t know the address or have not resided in Japan.*

Please refer to the list of currencies for direct deposit to foreign countries. Currencies are specified for each country and you may not choose other currencies.

Currencies for Direct Deposit to Foreign Countries(PDF)

* Please note that while you reside outside Japan, you may register your account of a bank located in Japan for direct deposit, except for Japan Post Bank.