Employees' Pension Insurance System and Employees' Health Insurance System

Page ID:100-510-043-743

Last updated date:11 28 2025

The Employees’ Pension Insurance (EPI) and The Employees’ Health Insurance (EHI) are designed to help stabilize livelihood of company workers, in case of old age, disability or death. For this purpose, these workers shall pay salary-based contributions.

The coverage under EPI / EHI is compulsory by law, and it is not a contract which employers or workers may opt for the coverage or may withdraw.

Company workers shall be covered by EPI / EHI in unit of workplace. The employers are responsible for necessary procedures for coverage and pay insurance contributions which are evenly shared by the employers and their employees.

Coverage

Compulsory Coverage

You must be covered by EPI / EHI if you work for a company or a factory which employs 5 workers or more, or if you work for a HOJIN corporation in principal (including employers); referred to as mandatorily covered workplaces. Specifically, a company or a factory here means one in business specified by law, such as manufacturers. Foreign nationals permitted to work based on their resident status must also be covered regardless of their nationality.

If you are a part-timer, you must be covered if your weekly work hours and monthly work days are three fourth or more of those for regular workers in the same workplace. If your work hours and work days are less than that, you still must be covered if all the following 5 conditions apply to you: (1) your weekly work hours are 20 hours or more, (2) your employment term is expected to be two months or longer, (3) your monthly wage is ¥88,000 or more, (4) you are not a student, and (5) you are employed by a "specific covered workplace."*

* "Specific covered workplace" means:

(1) A workplace under one registered HOJIN (company) number, which is expected to employ more than 50 workers in 6 months or longer per year

(2) A workplace with 50 workers or less, which apply for coverage on the agreement between the employer and the workers

Note: Workers who are sent to temporarily work in Japan from a country which has Social Security Agreement with Japan, may be exempted from EPI coverage: See for details.

How to Enroll in the System

Your employer must submit the "Application to Enroll in Employees' Health Insurance / Employees' Pension Insurance" (SHIKAKU SHUTOKU TODOKE - KENKO HOKEN / KOSEI NENKIN HOKEN) if you are subject to coverage under EPI / EHI, within 5 days after your employment, to the Japan Pension Service branch office (JPS branch office) or the processing center which covers your company.

Application form

Application to Enroll in EPI / EHI (SHIKAKU SHUTOKU TODOKE)

Note 1: Your employer must submit the "Application for Workplace Coverage" (SHINKI TEKIYO TODOKE) if your company becomes subject to coverage under EPI / EHI.

Application for Workplace Coverage (SHINKI TEKIYO TODOKE)

Note 2: Please visit the website of the ![]() Japan Health Insurance Association(外部リンク) for voluntary and continuous coverage of the EHI after retirement.

Japan Health Insurance Association(外部リンク) for voluntary and continuous coverage of the EHI after retirement.

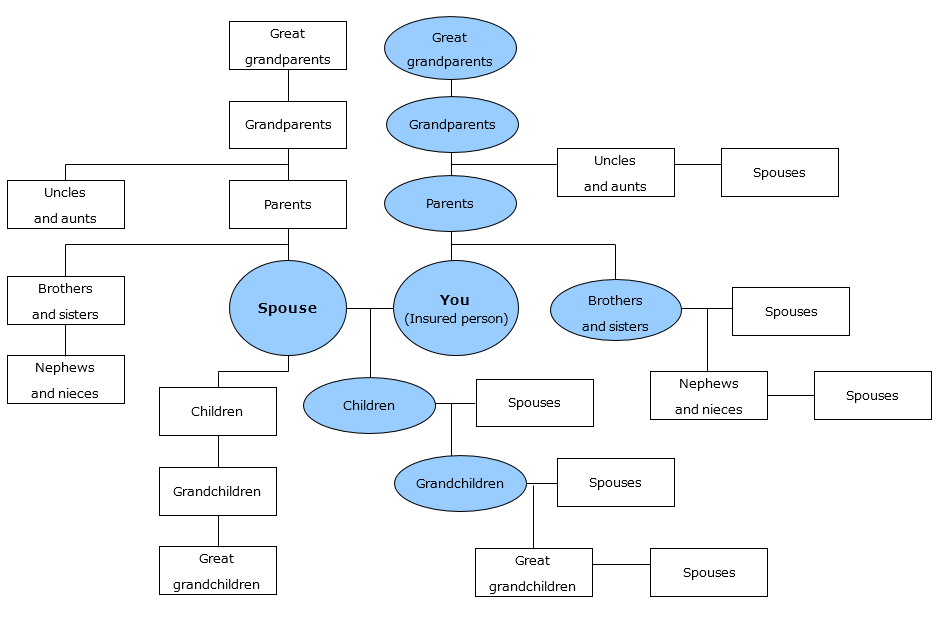

Coverage of Your Dependents

Your dependent family members can apply for coverage if they are your first, second or third level of your family members or relatives (see the chart below) and if they have registered their residence in Japan*. To be approved as dependents to be covered, they need to be financially supported mainly by you.

* Even without registered residence in Japan, however, a dependent who temporarily stays abroad may be applicable if he/she is, for example, a student studying abroad, or a family member who accompanies an insured worker detached to work abroad.

When your dependent has an income, he/she is applicable if:

- he/she lives with you and has an annual income of less than ¥1.3 million* AND less than half of your annual income**.

- he/she does not live with you and has an annual income of less than ¥1.3* million AND less than the annual financial support amount provided by you.

* ¥1.8 million if he/she is aged 60 or older or has a certain level of disability

** When a dependent’s income is more than half of yours, however, the Japan Pension Service may decide to cover the dependent under EHI, if the dependent’s annual income is not more than yours, and if the result of comprehensive examination provides enough ground to recognize that you play the primary role in household economy.

How to Enroll in the System

When your dependents become eligible for coverage or if there is any change to your dependent's coverage status, your employer must submit the “Report of Dependents (change)" (HIFUYOSHA IDO TODOKE) within 5 days after the change, to the JPS branch office or the processing centers which covers your company.

Report form

EHI: Report of Dependent(change) (HIFUYOSHA IDO TODOKE)

Contribution

Your contribution amounts are calculated by applying the contribution rate to your monthly salaries (Standard Monthly Remuneration*) and your bonuses (Standard Bonus Amount**,) which are paid half by your employer and half by you.

Your employer must deduct contribution from your monthly salaries and bonuses, and then pay the contribution (together with those paid by the employer) by due date*** (for example, contribution for April must be paid by May 31.)

- Contribution amount for regular months (without bonus payment) = Your Standard Monthly Remuneration* × Contribution rate ****

- Contribution amount for bonus months (regular salary + bonus) = Your Standard Monthly Remuneration* × Contribution rate **** + Your Standard Bonus Amount** × Contribution rate****

* Standard Monthly Remuneration (monthly amount of pensionable remuneration)

The Standard Monthly Remuneration serves as the basis for calculating the benefits and insurance contributions for EPI / EHI. Your actual remuneration paid by the employer is classified into the prescribed remuneration table, and your Standard Monthly Remuneration is determined. Your remuneration includes every payment such as salary, wage and any allowance which you receive from your employer in return of your work. However, the bonus and such received at intervals of more than 3 months are excluded.

** Standard Bonus Amount

The Standard Bonus Amount is the amount of bonus you receive from your employer at intervals of more than 3 months, rounded down to the nearest ¥1,000. The maximum of the Standard Bonus Amount for the purpose of contribution calculation under EHI is ¥5.73 million in total of bonus payments in one fiscal year (from April 1 to March 31.) The maximum Standard Bonus Amount under EPI is ¥1.5 million per month.

*** Due date (of monthly contribution payment)

Contribution for a certain month must be paid by the last day of the following month. If the last day of a month is a holiday, the due date is the first business day after the holiday.

**** Contribution rate

Contribution rates are specified separately for EPI and EHI.

For EPI, see EPI contribution amount table

![]() For EHI, see the website of the Japan Health Insurance Association(外部リンク)

For EHI, see the website of the Japan Health Insurance Association(外部リンク)

Note: When you take maternity leave or childcare leave, both you and your employer may be exempt from contribution payments upon application.

Benefits

Old-age Employees' Pension for age 60-64

If you have one year or more of EPI coverage periods and if you satisfy the contribution requirement to qualify for the Old-age Basic Pension under the National Pension system, you can receive the specially-provided Old-age Employees' Pension (TOKUBETSU SHIKYUNO ROREI KOSEI NENKIN) from your pensionable age to 65. The pensionable age for this pension is being raised in stages according to date of birth.

Benefit Amount (Fiscal year 2025)

Annual amount of your specially-provided Old-age Employees' Pension = (A) + (B) + (C)

(A) Fixed Amount Portion*

\1,628 × 1.065** (rate for the fiscal year 2025)× multiplier depending on your date of birth *** × Number of your covered months (up to 480 months****)

* The pensionable age for the fixed amount portion is being raised in stages according to date of birth.

** 1.062 for a beneficiary born on or before April 1, 1956.![]() *** Refer to multiplier chart.(PDF 42KB)

*** Refer to multiplier chart.(PDF 42KB)

**** This amount varies depending on your date of birth.

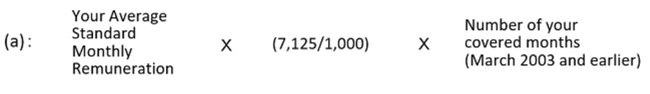

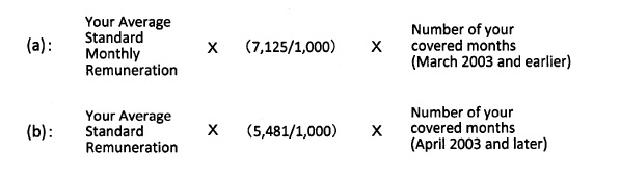

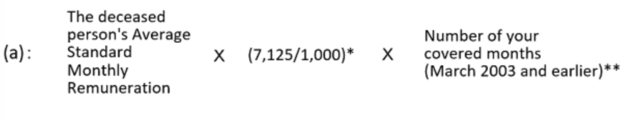

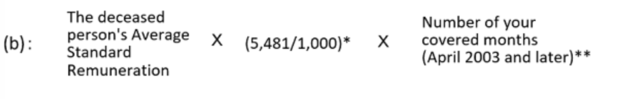

(B) Remuneration-related Portion

(a) + (b)

* Your Average Standard Monthly Remunerations of March 2003 and earlier, reassessed to the current value and divided by the number of your covered months including March 2003 and earlier.

** This amount varies depending on your date of birth.

*** Total of your Average Standard Monthly Remunerations and Standard Bonuses in April 2003 and later, reassessed to the current value and divided by the number of your covered months including April 2003 and later.

(C) Additional annual benefits

If you have periods of EPI coverage for 20 years or more in total, or for 15 to 19 years after age 40 (age 35 for women), and if you have dependent family members when you reach age 65 in principle, you can receive additional annual benefits. Eligible dependent family members include;

(1) your dependent spouse younger than age 65, except that your spouse has periods of EPI coverage for 20 years or more in total, or for 15 to 19 years after age 40 (age 35 for women)

(2) your dependent child(ren) who is under age 18 (until first March 31 after his/her 18th birthday) or age 20 if he/she has a certain grade of disability specified by pension law

Additional annual benefit amount

- ¥239,300 for your spouse*

- ¥239,300 each for your first and second child

- ¥79,800 each for your third and subsequent child(ren)

* Depending on your date of birth, special supplement may be added to this additional annual benefit for your spouse.

How to Claim Your Benefits

You need to file the "Application for Pension: Old-age Benefits under National Pension / Employees' Pension Insurance" (NENKIN SEIKYUSHO: KOKUMIN NENKIN / KOSEI NENKIN HOKEN ROREI KYUFU) to your nearest JPS branch office or pension consultation center (PCC.)

You need to provide following documents:

(1) an official document which shows your Basic Pension Number, including your Basic Pension Number Notice and Pension Handbook

(2) a certified extract copy of your Family Registry (KOSEKI SHOHON)

(3) other documents if needed for individual cases

Please contact the JPS branch office to find about specific documents, which may vary depending on your conditions.

Early Payment of Old-age Pension for age 60-64

In principle, the pensionable age for Old-age Basic Pension and Old-age Employees’ Pension is 65. However, you may opt to start early payment any time between your 60th birth month and the previous month of your 65th birth month. Please note that if you opt for early payment, the benefits amount is reduced.

Old-age Employees' Pension for age 60-64 while you work

While you work and are covered by EPI, your specially-provided Old-age Employees' Pension for age 60-64 will be either reduced or suspended if the total of your monthly pension payable and your monthly remuneration from your work is more than ¥510,000.

Old-age Employees' Pension for age 60-64 and Employment Insurance benefits

While you receive the Unemployment Basic Allowance paid under the Employment Insurance Act, your specially-provided Old-age Employees' Pension for age 60-64 will be suspended.

While you work and receive the continuous employment benefits for the elderly which is paid under the Employment Insurance Act, your specially-provided Old-age Employees' Pension amount is adjusted by considering your continuous employment benefits, in addition to the adjustment explained in "Old-age Employees' Pension for age 60-64 while you work" above.

Old-age Employees' Pension after age 65

You can receive the Old-age Employees' Pension on top of your Old-age Basic Pension at the age of 65, if you have one month and more coverage periods under EPI and if you satisfy contribution requirements to qualify for the Old-age Basic Pension under the National Pension system.

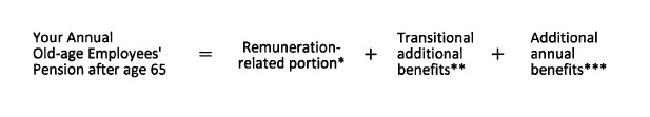

Benefit Amount (Fiscal year 2025)

* Same formula as the specially-provided Old-age Employees' Pension for age 60-64

** Equivalent to the difference, if any, between your "Fixed Amount Portion of the specially-provided Old-age Employees' Pension for age 60-64" and your "Old-age Basic Pension amount"

*** Same formula as additional annual benefits of the specially-provided Old-age Employees' Pension for age 60-64

How to Claim Your Benefits

You need to file the "Application for Pension (the Old-age Benefits under National Pension / Employees' Pension Insurance)" (NENKIN SEIKYUSHO - KOKUMIN NENKIN / KOSEI NENKIN HOKEN ROREI KYUFU) to your nearest JPS branch office or PCC.

You need to provide following documents:

(1) an official document which shows your Basic Pension Number, including your Basic Pension Number Notice and Pension Handbook

(2) a certified extract copy of your Family Registry (KOSEKI SHOHON)

(3) other documents if needed for individual cases

Please contact the JPS branch office to find about specific documents, which may vary depending on your conditions.

When you reach age 65, while receiving the specially-provided Old-age Employees' Pension for age 60-64, you only need to fill in a postcard version of the same claim form which is sent to you in the early part of your birth month, and send it to the JPS Headquarters in Tokyo.

If you opt to delay payments of both Old-age Basic Pension and Old-age Employees’ Pension to age 66 or later, you don’t need to file the application. Please file the application when you want to start delayed pension payment.

Old-age Employees' Pension after age 65 while you work

Your Old-age Employees' Pension after age 65 will be either reduced or suspended while you work and are covered by EPI and the total of your monthly pension payable and your monthly remuneration from your work is more than ¥510,000.

Disability Employees' Pension and Disability Allowance

You can receive the Disability Employees' Pension in addition to the Disability Basic Pension when you have a disability specified as Grade 1 or Grade 2 for the Basic Disability Pension, and you had the first medical or dental examination of the sickness or injury which caused the disability while you were covered by EPI.

If your disability is lighter than Grade 2 level, you can receive the Disability Employees’ Pension for the Grade 3 disability.

Also, the Disability Allowance (lump-sum benefits) is paid if you recover from a sickness or injury within five years from the first medical examination and still have the disability which is lighter than Grade 3.

Please note that in order to receive the benefits/lump-sum you must satisfy one of the two following contribution payment requirements as of the previous day of the date of your first medical examination.

(1) Two thirds or more of your past period of public pension coverage is filled with your contribution-paid periods and contribution-exempted periods (paid or exempted up to 2 months prior to your first medical examination month.)

(2) You are aged under 65 on the date of your first medical examination, and you have paid contributions or you were exempted from the contribution payments for 12 consecutive months up to 2 months prior to your first medical examination month.

Benefit Amount (Fiscal year 2025)

Disability Pension

- Grade 1 Disability Employees' Pension = ( (a) + (b) ) × 1.25 + (c) + Disability Basic Pension (¥1,039,625*)

- Grade 2 Disability Employees' Pension = (a) + (b) + (c) + Disability Basic Pension (¥831,700**)

- Grade 3 Disability Employees' Pension = (a) + (b) (Guaranteed minimum benefit is ¥623,800***)

* ¥1,036,625 for a beneficiary born on or before April 1, 1956

** ¥829,300 for a beneficiary born on or before April 1, 1956

*** ¥622,000 for a beneficiary born on or before April 1, 1956

Disability Allowance (lump-sum payment)

Disability Allowance = ( (a) + (b) ) × 2

(Guaranteed minimum benefit is ¥1,247,600*)

* ¥1,244,000 for a beneficiary born on or before April 1, 1956

Note: When the total number of your covered months (referred in (a) and (b) above) is actually less than 300 (25 years,) 300 is used as guaranteed minimum.

How to Claim Your Disability Employees' Pension

You need to file the "Application for Pension: Disability Benefits under National Pension / Employees' Pension Insurance" (NENKIN SEIKYUSHO - KOKUMIN NENKIN / KOSEI NENKIN HOKEN - SHOGAI KYUFU) to your nearest JPS branch office or PCC.

You need to provide following documents:

(1) an official document which shows your Basic Pension Number, including your Basic Pension Number Notice and Pension Handbook

(2) a certified extract copy of your Family Registry (KOSEKI SHOHON)

(3) the certificate of diagnoses issued by your medical doctor

(4) your report on your medical history and on how your disability affects your work / everyday life

(5) other documents if necessary for individual cases

Please contact the JPS branch office to find about specific documents, which may vary depending on your conditions.

Survivors' Employees' Pension

The deceased person's survivors can receive the Survivors' Employees' Pension if they are financially dependent on a deceased person before his/her death and if one of the following applies at the time of his/her death:

- The deceased person is an insured person under EPI. Or, the person dies within 5 years because of an illness or injury for which he/she had the first medical consultation while he/she was covered by EPI. The deceased person needs to satisfy same contribution requirements as that for the Survivors’ Basic Pension.

- The deceased person has 25 years or more coverage periods i.e., contribution-paid periods and contribution-exempted periods including various complementary periods

- The deceased person is eligible for the Disability Employees' Pension (Grade 1 or 2.)

The spouse of the deceased person, who takes care of his/her dependent child(ren) or his/her child(ren) can receive the Survivors' Employees' Pension in addition to the Survivors' Basic Pension.

The benefit is awarded to the survivors in the order as follows:

(1) The spouse of the deceased who takes care of his/her child(ren)

(2) The deceased person's child(ren) who is under age 18 (until first March 31 after his/her 18th birthday) or age 20 if he/she has a certain grade of disability specified by pension law*

(3) The spouse** of the deceased with no children

(4) The deceased person's mother and father***

(5) The deceased person's grandchild(ren) who is under age 18 (until first March 31 after his/her 18th birthday) or age 20 if he/she has a certain grade of disability specified by pension law

(6) The deceased person's grandmother and grandfather***

* While the wife of the deceased who takes care of his/her child(ren) or the husband aged 55 or older is receiving the Survivors' Employees' Pension, the deceased person's child(ren) will not receive the Survivors' Employees' Pension,

** The deceased person's wife under age 30 with no children can receive the Survivors' Employees' Pension only for 5 years. In addition, the deceased person's husband with no children can receive the Survivors' Employees' Pension only if he aged 55 and over. However, the benefits begin at age 60 (the Survivors' Employees' Pension can be received between the age of 55 and 60 only if the Survivors’ Basic Pension can be received together.)

*** The deceased person's parents and grandparents can receive the Survivors' Employees' Pension only if they are aged 55 and over. However, the benefits begin at age 60.

Benefit Amount (Fiscal year 2025)

The spouse* of the deceased who takes care of his/her child(ren)* or his/her child(ren)

( (a) + (b) ) × 3/4 + Survivors' Basic Pension (¥831,700** + additional annual benefits for child(ren))

Additional annual benefits for child(ren)

- ¥239,300 each for the first and second child

- ¥79,800 each for the third and subsequent child

* The spouse needs to live with his/her child(ren) who is eligible for the Survivors' Basic Pension.

** ¥829,300 for a survivor of the deceased person born on or before April 1, 1956

Other eligible survivors

( (a) + (b) ) × 3/4

* The ratio varies according to the deceased person's date of birth if the deceased person was eligible for the Old-age Employees' Pension before his/her death.

** Different formula is used when the total number of the deceased person’s covered months ( (a) + (b) ) is actually less than 300 months (25 years.)

How to Claim Your Survivors' Employees' Pension

You need to file the "Application for Pension: Survivors' Benefits under National Pension / Employees' Pension Insurance" (NENKIN SEIKYUSHO - KOKUMIN NENKIN / KOSEI NENKIN HOKEN - IZOKU KYUFU) to your nearest JPS branch office or PCC.

You need to provide following documents:

(1) an official document which shows deceased person’s Basic Pension Number, including his/her Basic Pension Number Notice and Pension Handbook

(2) a certified copy of his/her Family Registry (KOSEKI TOHON,) or an official copy of the list of legal heir (HOTEI SOZOKU JOHO ICHIRANZU) which can be issued by Legal Affairs Bureau

(3) a medical certificate on his/her death issued by a medical doctor

(4) other documents if we individually need

Please contact the JPS branch office to find about specific documents, which may vary depending on your conditions.

Revision of the Pension Amount

The pension amount is revised each fiscal year according to changes in wages and prices, as stipulated by law. If your pension amount is revised, you will receive "Notice of Pension Amount Change." (shown below.)

Following information are indicated in each block on the Notice you receive:

(1) Annual amount of your National Pension (Basic Pension); basic benefits, suspended amount, and total benefits to be paid

(2) Annual amount of your Employees' Pension Insurance; basic benefits, suspended amount and total benefits to be paid

(3) Annual total pension amount; sum of your National Pension benefits and your Employees' Pension Insurance benefits to be paid

Note: Pension benefits are, in principle, paid in even-numbered months (February, April, June, August, October, and December,) in amount of two months’ benefits.

Lump-sum Withdrawal Payments (Exclusively for Non-Japanese Citizens)

If you are not a Japanese citizen and you had resided in Japan and been covered by EPI for a short time, you can claim the Lump-sum Withdrawal Payments within two years after your departure from Japan. You can claim the Payments if you have at least 6 months of coverage periods under EPI and you are not eligible to receive Old-age Employees’ pension. Please refer to the "Lump-sum Withdrawal Payments" details / application form in English, Chinese, Korean, Portuguese, Spanish, Indonesian, Tagalog, Thai, Vietnamese, Myanmar, Khmer, Russian, Nepali and Mongolian.

Direct Deposit to Foreign Countries

If you reside outside Japan and want your Japanese pension benefits or lump-sum benefits deposited to your account of a bank located outside Japan, you need to submit the form to report your bank details for direct deposit (PDF) to the JPS branch office which is in charge of your final address in Japan, or any JPS branch office if you don’t know the address or have not resided in Japan.*

Please refer to the list of currencies for direct deposit to foreign countries. Currencies are specified for each country and you may not choose other currencies.

Currencies for Direct Deposit to Foreign Countries(PDF)

* Please note that while you reside outside Japan, you may register your account of a bank located in Japan for direct deposit, except for Japan Post Bank.